Today we look at how to choose a health insurance plan – should you get a PPO, an HMO, or a HDHP? What is an HSA? And what do those acronyms mean anyway? What if you get free money from work?

Open Enrollment is starting for many people! This is the time of year when you can enroll, so we are devoting multiple episodes this month to untangling the mess of American health care bureaucracy as part of our Health Care Month 2018. If you’re a non-US listener, here are some cute cat videos to watch instead.

We are taking your health care questions all month on Oh My Dollar! The more questions you ask, the more Will learns. Send in to questions@ohmydollar.com or via twitter to @ohmydollar

Acronyms in this episode:

A PPO – A preferred provider organization – a typical American health insurance plan, where you have in-network and out-of-network providers as part of a “network” of doctors

- Usually easier to find doctors you jive with or who understand your particular needs

- May be your only option

HMO – Health management organization – a bundled type of health insurance where the network and health insurance organization are integrated

- Can be good for someone who is “lazy” (AKA overwhelmed trying to figure out how to get care) – you’ll be assigned a doctor and treatment protocol

- -Often have integrated systems – all doctors can see the same records, pharmacy is linked to the doctors, making things easier

- Harder to get care that deviates for a “norm” – can be challenging if you have trans* health needs or want experimental/newer treatment for something

- You often can’t get anything covered to see a specific doctor unless they are part of the HMO plan or if you get a specific recommendation letter from your primary care doctor.

HDHP – High Deductible Health Plan – a type of health insurance where you have lower premiums and higher deductibles

HSA – Health Savings Account – a type of health savings plan that is tax free (only for HDHP users)

- You can save with a Payroll deduction

- Your company can contribute tax-free dollars for you (extra tax free income for you)

- It’s like a regular savings account, and you can keep it when you leave

- You can invest a portion of the account

FSA – Flexible Spending Account – a type of health savings plan thatdoes not roll over year to year but can be used by most anyone regardless of type of plan

Things to Know When Shopping for Health Care

Generally higher the premium, lower the deductible.

Related Episodes:

- Your Trump Health Insurance Questions Answered

- Untangling COBRA and Healthcare.gov premiums

- Are Health Savings Accounts an evil Republican tax loophole or actual magic?

- Mistakes not to make with health insurance ft Jack Hopper (long cut)

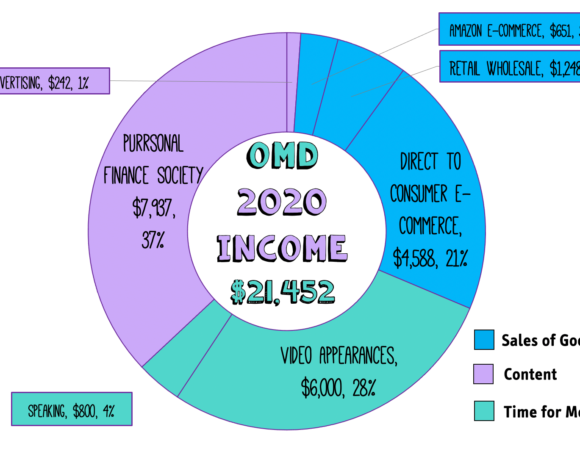

Thanks to our Purrsonal Finance Society Members on patreon, we now have transcripts!

This Week’s Transcript

OMD 10.17.2018. How to choose a health plan

: This show is supported by generous listeners like you through our Patreon. This episode was underwritten by Surreptitious Huggermugger Foundation, the Tamson G Association, and Chris Giddings.

Http://www.ohmydollar.com/support/

To learn more about ways to support Oh My Dollar! and get cool perks like exclusive livestreams and cat stickers, you can visit Ohmydollar.com/support.

: Welcome to Oh My Dollar!, a personal finance show with a dash of glitter

: Dealing with money can be scary and stressful. Here we give practical, friendly advice about money that helps you tackle the financial overwhelm. I’m your host Lillian Karabaic

: And I’m your other host, Will Romey.

: So it is the season, Will – open enrollment.

: I feel like it was just that season, and I just got used to having the health care plan I had.

: I think it’s because 2018 has been such a spiral of – I don’t want to say crazy. It’s been such a spiral of terrible and never-ending onslaught, that it really feels like it was just a moment ago. But in fact open enrollment was a year ago and open enrollment season just so folks know if you don’t know if you have health care through your job. Usually there will be a time of year when you can enroll in a new plan or if you weren’t previously enrolled you will be able to enroll just at that time per year in a plan at all. Otherwise you usually need what is called a change of life status. And that usually involves getting married, getting divorced, having a kid, or losing insurance. And other than that you have to wait until open enrollment and the time is now for most folks who if you get your insurance through an exchange like healthcare.gov – for healthcare.gov, It starts on November 1st. But you can get ready ready right now. And you will be super-prepared when it opens. And this is a this is a big deal. So with healthcare being a huge expense in these American states we are going to devote multiple episodes this month to untangling the mess of money confusion in health care costs.

: This was helpful to me last year I think my health care plan was the best I had this year.

: Oh I’m so glad to hear that.

: Or at least it made more sense than I think I did a good job of using it more – not because I was injured but because I took more advantage of provisions that I had.

: Yeah. What’s cool is that once you kind of know your way around you find out that there are a lot of things that you actually can get for free. So if you’re paying for health care you know it’s nice to be able to get get some of the things that you’re entitled to for free.

: Exactly without injuring yourself.

: So if you are one of our Canadian, Australian, UK, or Indonesian listeners did you know that we’re a top 10 personal finance on Indonesian iTunes.

: I had no idea, that’s great. Hi Indonesia!

: I have no idea why but that’s awesome. This show probably won’t be applicable to you if you fall in that category unless you have a morbid fascination with the wild inefficiencies and high costs of American health care. Sorry I’ve linked to some cute cat videos in the show notes that you can watch instead and you can just rub your nice socialist healthcare all over yourself.

: I just got back from a trip to Europe and actually had a really interesting conversation with a rich Chinese tourists and our tech tour guide. They were horrified by American healthcare and how it works.

: I feel like the most common questions I get when I’m abroad are “why does America not want healthcare?”

: And it’s like it’s not. It’s not that. *laughing*

: I think people underestimate the scale at which how big America is. If you come from one of the smaller European countries, I think it’s hard to understand that we in essence operate like 50 EU countries and not like one large country. From a regulation standpoint. Anyway that’s a different policy episode.

: Different podcasts, we’ll get there.

: But just start off our Health Care Month, We have a question from listener Devon in L.A.

: Devon says I have a choice between a PPO plan and an HDHP plan at my job my employer covers all the premium for both plans but if I get an HDHP my employer will put a one thousand dollar HSA account for me. What plans should I choose? I know one of those acronyms.

: Yeah there’s a lot of acronyms going on.

: Oh two of them! I know LA.

: Well, Devon in LA. This is an excellent question but I don’t have enough information yet to let you know which one to choose. So the first thing to do, Let me explain some of these acronyms. So there is a difference between what is called a PPO and HDHP plan. So the first PPO is what most people are used to kind of getting under American healthcare which is a preferred provider organization. The name doesn’t really matter but this is what most people think of when they think of typical American health insurance where part of your costs are covered and you have a list of in-network and out-of-network providers and out-of-network ones cost more usually, sometimes are not covered at all and a PPO will cover a percentage of your costs for healthcare after you hit what’s called your deductible. You’re usually responsible for your costs until you hit your deductible, but there are a few exceptions to that – your annual exam, ob-gyn annual exam, co-pays for certain drugs and certain screenings will usually be covered even if you haven’t hit the deductible yet. Generally your deductible is relatively low on a PPO. Sometimes as little as 50 or 100 dollars, but more commonly it is about 500 dollars per person. I saw a recent study that said the average one was $643 on a PPO.

: So a PPO is a regular normal health care plan. If that’s a thing.

: Yeah it’s hard to say what’s regular or normal in the United States because we have such a hodgepodge of different kinds of ways that people approach health care. That being said, when most people of our parents’ generation think of health insurance through their job, they are probably thinking of a PPO.

: So like my, Kaiser Permanente the marketplace plan – that’s a PPO.

: Actually that is what’s called an HMO which is a third acronym we didn’t even introduce, which is a health management organization. There aren’t that many HMOs out there. But what an HMO is essentially – The simple way to understand it is almost everything is integrated and in network. So PPO is more like a network. Like literally it’s a network of doctors and hospitals that are preferred versus Kaiser is a health management organization because all the doctors are employed by Kaiser

: And they own their hospital and all that.

: Yes exactly.

: Ok. Bad example. *laughing*

And but that’s actually really important because a lot of people might not understand the difference between an HMO and a PPO. If you do have the HMOs are way less common there’s just less of them. In Oregon, a lot of people have them because Kaiser is from Oregon and it is a fairly large insurer here. So a lot of people do have an HMO.

: They tend to be the same as far as the dollars in your pocket, from a premium perspective they usually don’t vary. The big thing to kind of understand with HMOs is that sometimes it can be harder to get approval or coverage for what is considered kind of “alternative” or if you want to go see a specific doctor. If they’re not in the Kaiser network, you may not be able to see them at all.

: Right. So that makes sense.

: You’re going to have to pay out of pocket. A lot of people do like HMOs. So, I really liked Kaiser, when I was on it because what was nice for me – everything was in the same building. Everything was integrated in the same medical records system. It was just super easy to pull everything up.

: Yup – and said building is like a block away from home. It’s very convenient.

: They just assigned me a doctor. So it was very good. If you’re someone who’s lazy and like doesn’t want to have to go hunt and figure out if someone’s in network or out of network and try to find a primary care provider, an HMO will usually just assign.

: Yup, I tell them I’m sick, they tell me what to do about it. That’s kind of what I’m looking for.

: Yeah yeah. So it can be really good if you’re kind of lazy and overwhelmed, which is which is fine. I’m not saying that’s a bad thing. Health health insurance in the U.S. is so frustrating, and so hard – you know, make it easier on yourself sometimes if people are dealing with a really big medical event. So either they have a chronic illness that has kind of some new treatments going on or they have cancer or some very complicated to manage disease. HMOs can be kind of frustrating for people because it can often be harder to figure out how to get care that kind of deviates from the norm. Right. They really like to put you through the track of whatever they’ve kind of decided it’s there’s usually a treatment protocol.

: This is true for both a PPO and HMO. In health insurance, similar to most other kinds of insurance, the higher the deductible the lower the premium. Usually. This is why a high deductible plan or an HDHP is something a lot of employers are trying to push on employees these days. The high deductible plan must have a deductible of at least two thousand seven hundred dollars to be considered high deductible, which compared to a five hundred dollar deductible, you can see why that’s high.

: I’m on a high deductible plan and might adoptable is six thousand five hundred dollars. If you do have a high deductible plan you qualify for the special savings account which is called a health savings account or an HSA. And this is a special medical savings account that magically avoids taxes as long as you use it for medical expenses. So remember how we’ve talked about Roth versus traditional when it comes to investing and saving for retirement?

: Yea, in IRAs specifically, right?

: Yeah, well both 401k and IRAs so – so Roth is something where it is post-tax, which means you pay taxes on it now but you don’t pay taxes when you pull it out later. With the traditional you pay taxes on it you don’t pay taxes on it now which allows you to put slightly more in because it’s pre-tax you spent a lot of time talking about that but then you’ll pay taxes on it when you withdraw it at retirement age. A health savings account is the only type of magical account that avoids taxes on both sides. So you put in pre-tax money and you don’t have to pay taxes when you pull it out as long as you use it for medical expenses.

: So it’s a good way to save money specifically for medical expenses.

: Yes.

: Probably the best way.

: Yeah it’s really it’s quite awesome and it allows you a lot more flexibility in how you use or save health dollars. Because one of the things that can be very frustrating about health insurance is that often you don’t have a lot of choice in what kind of like treatment protocol that you can use. You know maybe you want massages or something like that for treatment but you can’t get a approval for it. You will be able to spend HSA dollars on that so you can only use your HSA for health care costs. But the range of what’s considered health care cost is often wider than what your traditional healthcare plan might cover. And you can put money into this account directly before taxes, out of your paycheck. So it could just be a payroll deduction if you have a traditional employer.

: Oh that’s neat.

: So it just it just happens.

: Like the same as people do IRA deductions?

: Yea, The same as you do with your retirement deductions! Or, you know, your uniform or your transit pass deductions at your job. Your company might also contribute tax-free money in your account. This is the a thousand dollars that Devon is saying that they would seed the account with, so they can put money in that. And it’s tax free extra income for you, and it’s yours to keep. So what’s so cool about the HSA is it’s like a regular savings account as it will earn interest and part of it can be invested, though the profits are only tax free if you use them for health care costs. But they are tax free if you use them for health care costs!

: And it rolls over every year. It’s your account to keep. And after age 65 whatever you have in there actually converts to a regular retirement account. And it can be withdrawn for any type of expense without penalty. So the money in your HSA is 100 percent yours to keep. If you leave your job for whatever reason, the HSA stays with you. So it’s like a special medical emergency fund which in your case Devon, is actually just your job is giving you a thousand dollars to put in a special medical emergency which is great which is awesome. The only thing that you really can’t use your HSA for that’s a healthcare expense is to pay for premiums. There’s a couple exceptions to this so you can use it to pay for your COBRA premium so if you like lost your job and you had COBRA coverage which we’ve talked before usually that’s the most expensive option and you don’t want to do that. But there’s rare cases where you might or if you are getting long term care insurance after a certain age you might be able to use your HSA money.

: Well that’s good to know because that was the first thing that the notice is a great way to keep your kind of regular plan paid off.

: Yeah. So you can’t you can’t pay your premium on it but you can pay anything towards your deductible. And it’s – it’s just pretty awesome. So, the downside obviously of course is that you need to have one of these high deductible plans. So the main thing that you need to figure out is that if you aren’t paying the premium yourself because your employer covers it or they’re paying most of it, you know, obviously the premium is one of the main things you need to figure out if you’re choosing one of these and you’re paying all of it. Like if you’re on the exchange.

: But, otherwise the main thing you need to know is what the likelihood that you’ll use your health insurance is. So there’s two cases in which someone gains a lot by using an HDHP and HSA combo. That’s a mouthful. If they are so- Will, you’re probably a great example, if you have relatively low or no expected medical expenses most years, i.e. you’re a healthy person without anyone without a history of medical issues. That is a you’re usually a really awesome option for it. So one of the reasons this is great is kind of obvious. You’ll pay less in premiums your premiums will be lower because it’s a high deductible plan, which will save you money. And you can save some money tax free – in Devon’s case the company is giving you some money to save tax free, but you’ll still have insurance in the case of some unforeseen and medical event like appendicitis or a traffic crash, which could bankrupt you otherwise. So why would you want an HSA if you have high medical costs? Any ideas.

: Because you’re going to go right through that premium I assume.

: Yeah. So for some people you may you might be able to run the numbers. And there is a case if you have a really expensive illness that costs a lot to manage – you know type 2 diabetes is a great example.

: Right. I mean you’re paying a lot of money on supplies to treat regularly.

: And you know you need regular treatments and checks and there’s just a lot of kind of overall expenses or epilepsy or something like that then you might be in the case where the amount that you save on premiums, kind of offsets that extra deductible that you’re paying and you’re going to be able to use that tax free money in that HSA in order to meet that deductible. So there are many people that fall into that category where they know they’re going to burn through their twenty five hundred dollar deductible but the amount that they’re going to save on taxes by being able to put money in that health savings account ends up and the amount they save in premiums ends up weighing out of that. So, on a high deductible plan it is possible that your out-of-pocket maximum is going to be higher. So you know it’s more likely to be higher than it is on a PPO. If it’s really high – say ten thousand dollars. You want to make sure that that’s something you can stomach if you were to have an expensive situation. Obviously being ten thousand dollars in medical debt is still better than being a million dollars in medical debt because you didn’t have any insurance.

: But it still doesn’t sound great. Yeah totally different scale there.

: And one of the things is if you have that HSA it will obviously help offset that and that you know ten thousand dollars of out-of-pocket.

: Right. Nine thousand dollars.

: Well you can put up to six thousand dollars in your HSA. One thousand would be. You know.

: The employer contribution.

: Sometimes employers will give you even more than that. They do have some limits on what they can contribute. But the main thing is you cannot have one of these HSA accounts unless you’re enrolled in an HDHP. So, not every plan that has a high deductible is considered an HSA-eligible HDHP and what you need to know is that it will have HSA in the name when you look at it.

: Ok so, an HSA will say HSA. An HDHP will say HSA.

: Yes. So you will actually see it on there. And that is one of the things to note because there are some specific federal regulations so things that might otherwise look like they qualify as an HDHP if they have an out-of-pocket maximum, that’s too high then they don’t qualify for the HSA which is ironic and weird but strange. If they cover anything before the deductible so if they cover like asthma inhalers at a 20 dollar copay before the deductible and then they won’t qualify anymore because they are not legally considered an HSA qualified HDHP.

: I see.

: But it will be very obvious on the enrollment forms.

: It will say it right there.

: It will say it right there. Other things you know about HSAs, you can’t be enrolled in Medicare. You cannot be claimed as a dependent on anyone else’s tax returns. So that could apply to some people listening to the show and you can’t be covered under your spouse’s flexible savings account. But you can still have a limited use flexible savings account for vision or dental. A lot of people get confused about the difference between an FSA and an HSA – a flexible spending account is like kind of less cool version of an HSA.

: Less specific I’d imagine, because of its flexibility.

: No and No. Believe it or not, an FSA is far less flexible. It actually expires it does not roll over and so that money is gone. And so it’s not a cool investible savings account. And there are much lower limits for the FSA. What it can be good for a lot of people get them through their employers were they’re just already filled with money and they can be excellent for things like buying glasses or paying dental since most dental has – It’s kind of terrible. We’ve talked about how dental insurance isn’t really that great. I mean it’s great if you have it and it’s free but.

: It’s nonsense.

: But it’s usually not that great if you have to pay out of pocket for it. But FSA can help you pay for that. And the other thing you need to know, is that you cannot contribute more than your net self employment income to an HSA if you are self-employed.

: Okay, that makes sense I guess. It would prevents you from transferring a lot of savings over to it I guess.

: Well, they’re trying to prevent you from essentially avoiding taxes because it’s tax-free money right. So you can’t go negative into your negative into profits because you contributed to an HSA.

: I see.

: They’re trying to avoid you know doing cool stuff with the HSA.

: There’s a good reason for it.

: Yeah. So essentially this is what you need to think about Devon.

: The likelihood that you’re going to use your health insurance – so if you’re in that really really high likelihood category, it’s possible that that a thousand dollars could make more of a difference than the difference in the deductible. On the flip side, if you’re really healthy and you know all you’re going to need is an annual exam, some screenings, and maybe incidental coverage for some medication. Let’s say that costs less than a thousand dollars a year which is the amount they’re putting in that HSA then it might make a lot of sense to have that each HDHP. One thing to always check is that out-of-pocket maximum.

: That’s pretty much it.

: Cool. That’s a lot of good information and I hope that will help you make that choice.

: Yeah and we are going to be talking about health care for the whole next month on Oh My dollar! So please, let us know if you have any questions you can always write in to question@ohmydollar.com

: The more questions you ask, the more I learn.

: Yes. The real goal is to make sure that Will has the best possible –

: – the best health Care plan and the best information about it I can.

: And also we have a quick reminder about our iTunes review – do you want to let people know about that?

: We are on a mission to get 50 reviews and 100 ratings on iTunes before the end of the year. Right now we are at 11 reviews and 40 ratings takes about three minutes to leave a review, so please help us out.

http://www.ohmydollar.com/support/

: And as always, if you want to learn more about our Patreon and ways that you can support the show for as low as a dollar a month, you can go to ohmydollar.com/support. There are cute cat videos. We’re also very close to our next goal where we’re going to have live streams where I answer questions every two weeks so you can get your questions answered sooner than when they’re on the show.

: That’ll be fun.

: And. I think that wraps our show for today, Will.

: I think it does.

: Our producer is Will Romey, and our intro music is by Aaron Parecki. I’m Lilian Karabaic, your personal finance educator and host. Thanks for listening. And till next time.

: Remember to manage your money, so it doesn’t manage you.

: *giggles*

: *giggles*