I’m really into New Year’s Resolutions. I actually set a relatively long list of goals each year, and I publicly record my successes & failures at the end of the year on my blog. This serves as an excellent annual review process and also a time to dream big.

I also love creating my budget afresh for the new year – and I think most folks should take a long look at their budget at least once a year, even if their finances are on relative autopilot. I like to think of budgeting as a way to set myself up for success in life, all around. While it’s great practice for financial management, I think that examining your budget annually can provide an excellent values-check and opportunity to look forward.

After 3 years of using and loving YNAB desktop version for my budgeting, I’ve decided to switch to new YNAB this year, and have delighted in setting up my budget to start fresh on January 1st, 2018. If you’re looking for a new way to budget, I highly recommend checking out YNAB – you can use this link to get a 34-day free trial, and I’ll get an extra month of YNAB free if you sign up at the end of your trial.

So here’s some things to consider in conducting an annual budget review.

Remember, there’s nothing magical about January 1st – you can start your annual budget review process anytime that works for you (right after you file taxes, perhaps?)

Look at your values & what you want more of

A lot of people associate the budget with deprivation, or giving up something. But I think that advantage of a well-tuned budget is that it gives you freedom to go after the big goals in your life. So use the annual budget review to consider where you’re at: What do you want more of in your life? More travel? More big meals with family? More live theatre? More air in your lungs after going up stairs? More quiet time on the weekends with tea? More endorphin rushes after exercising?

Last year, I took a “bucket list” dream trip from Dublin to Shanghai, China by train, and I budgeted for it for several years – this supported one of my core values of travel & exploration, but I didn’t afford it by accident.

When I look forward at the new year, I think about the activities associated with my core values, and then I think about the financial resources those will take. The things that emerged from my 2017 annual review was that I need to spend more time socializing and more time dancing.

Here’s how some of my core values (community, art, travel) factored into my annual budget review. In 2018 I want to:

- Spend more time dancing. Dancing is something that makes me feel awesome physically, socially, and mentally, but I often put off going to classes because I don’t set aside the money or the time. I created a goal in my budget to put aside $25 per month on dance classes, which is ~3 drop-in classes a month at my favorite dance studio (doable! but still more than last year!) Now, I will have that money there, staring at me, unused if I decide to skip class.

My bike drivetrain will cost $200 to replace, so I’m budgeting to have the money to do so before bike camping season.

- Spend more time bike camping with friends this summer. Last summer, I only went on one bike camping trip, and I didn’t spend enough time socializing with friends in general. Bike camping is pretty cheap as a hobby, but I need to set aside some money for campsite fees in the summer, and will need to pay for repairs to my drivetrain after the winter wears down my chain & cogs. So in YNAB, I’ve set up a goal to have $200 in my Bike repair budget by April to cover replacement of my drivetrain.

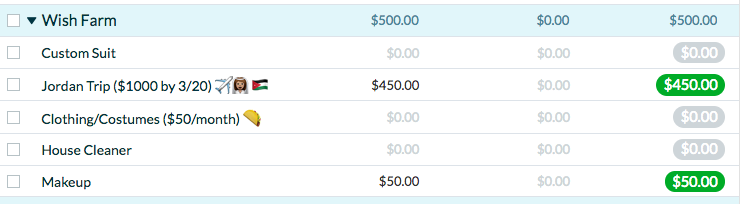

- I’d like to head to the Dead Sea for two friends’ wedding. I’m not 100% sure I can make this trip happen financially without putting some other goals on hold, but I’ve created a goal in my budget in my “wish farm” (the category for where I stash things that I’d like to be able to do). If I have any money left over in other categories, I can move it into this category at the end of the month.The goal feature in YNAB makes it easy for me to see if I’m on track to meet my goal in time – so by the point at which I’ll need to request off work & buy plane tickets (mid-February), I’ll be able to see if I’m able to afford the trip to Jordan.

This is my “wish farm” in my YNAB budget, ready for me to fill up when money is available.

This is my “wish farm” in my YNAB budget, ready for me to fill up when money is available.

Feel free to get creative when you’re identifying ways to live your values in your budget. Consider engineering in budget categories that will encourage you to do more of the things that represent your values. This could be explicit or implicit. Perhaps you want to see more movies with your family, and you figure that $10 a month for Moviepass will force you to go to the movies more than twice a month – that’s an explicit link.

But maybe you want to start volunteering at the local animal shelter every week, but know that you need to budget for a latte every week on the way there to get yourself motivated to go to the far-flung suburban shelter – that’s an implicit budget connection (also keep track of your miles, that mileage is tax deductible!)

In my case, in 2016, I wanted to get strong and I knew that paying for an unlimited membership on Classpass would force me to find a way to get $69 a month of value out of those high-end fitness classes. I ended up going to the gym an average of 6 days a week the entire year, and got in excellent shape, because I saw that $69 coming out of the budget every month.

Lastly, consider building in some philanthropy to organizations that work on your values every day – if you’re in the financial position to do some giving, setting up a monthly donation can make a world of difference to a small non-profit because it’s reliable income, even $10 a month adds up.

Reconsider your defaults

I love using my annual budget review to reset my categories and rethink the “default amounts” I put in my discretionary spending categories. For example, in 2015, I was averaging $153 a month at bars & restaurants every month. Now, I average less than $25 per month. This was a specific and concrete lifestyle change driven by looking at the budget and I don’t feel deprived (I still eat out whenever I want!) because I did it gradually.

It’s one thing to say that you’re going to “drink less next year” or “eat less fast food” – what if you back that up with some concrete budget numbers?

What if you say that you’ll reduce the amount you spend on bars or fast food by 2% each month – not a huge deal in January – maybe 1 fewer beer or french fries per month – but you’ve cut down by nearly 25% by the end of the year! And, because you’ve done it gradually, the habit is more likely to stick than if you go cold turkey.

Use the budget to get rid of emotional drains

I also like to use the budget check to see how the things in your life that are emotional drains could get solved. Perhaps for you, things that you hate in your life are always feeling like you’re behind, living paycheck to paycheck.

The annual budget check can be an excellent time to look forward at what it would take to stop being behind every month- maybe you see if you sold $500 worth of items, you could get yourself a one-paycheck buffer in your checking account and spend less time freaking out about bounced checks or declined cards. Or you can put all your debt into undebt.it and see what an extra $50 a month would do to your debt paydown.

The key here is to get into specifics: look at what driving for a rail-hailing service one night a week, picking up a catering shift, or what a 5% raise would do for your debt payoff plan. Don’t just go into vague “normal” resolutions like “pay down debt” or “earn more money” – come up with a concrete, realistic financial plan that helps you get rid of that emotional drain from being constantly behind.

I also think about the things I’m fed up with in my life – and if there’s ways I can throw financial resources at those to make them go away. I like Jen of Bullish’s suggestion to identify and replace small objects that annoy you. Her example is replacing all your scissors with fresh, sharp shears. Not actually terrible expensive (maybe less than $10), but now you’re not annoyed every single time you need to open a package or cut paper and the scissors merely fold the paper. Or paying a few dollars a month to upgrade your phone storage plan, and stop having to constantly delete cute cat photos to have available space.

So, figure out what those tiny things are in your life, and budget to get rid of them (mine was spending $20 on a mop instead of running out of swiffer pads all the time.)

Here’s some examples from my life of things I decided to throw financial resources at next year to make suck less.

- No more long commutes after cross-country flights. I made the decision to stop staying far out at sleezy motels to save a few bucks when traveling for work. I decided that the stress of a long commute in a strange city into conferences or speaking gigs is not worth the trade off of saving a few bucks on a hotel, most of the time. In November, I stayed at a hostel a 20 minute walk away from a conference venue, instead of a 90 minute multi-modal commute, and I was a much much better speaker and networker not being stressed about the last train back to my cheap motel.

- Stop spending so much time adjusting my stockings to cover up holes. I am a professional media lady. I appear on video and in front of large rooms of people and in meetings with people I am asking to give me money on a regular basis. I also ride my bike everywhere in all weather and travel over 50,000 air miles a year.

Because of this, it seems like I am always re- crossing my legs or wearing taller boots to hide runs in my tights, or just have weird toe blisters from stocking holes. 2018 is the year of no stocking-related toe injuries, so I budgeted to actually just replace my damn stockings when they break. I am eliminating my guilt about spending money on clothes I will destroy in under 6 weeks, and just set up a Subscribe & Save for stockings and a budget category to go with it.

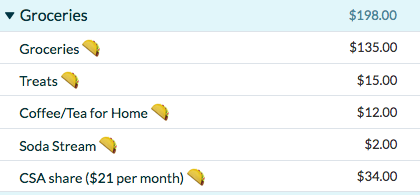

- Get rid of caffeine-related anxiety attacks. I have been having trouble with anxiety that I’ve linked to my coffee consumption. I’d like to find some quality caffeine-free teas, but tasting teas can be a pricey hobby – so I’ve budgeted some money for “tea for home” so that I can give myself permission to get a taster kit of different teas, instead of buying the cheapest tea at the discount grocery and then hating it and drinking coffee and then having a panic attack.

Don’t be surprised by completely unsurprising things

I don’t want to be surprised by large expenses. I hate having to adjust my budget when big expenses pop up, so I make sure I have “sinking funds” – small monthly savings in my budget for infrequent expenses. There are plenty of things in your life you know are going to happen this year that will cost you money.

For example, look forward at the calendar- do you expect to go to a wedding? Budget for the gift, the travel, and the outfit you’ll wear and maybe the pre-wedding events. Or maybe you want to go to a yoga teacher training? Or a conference in your field? Don’t act surprised when it pops up. Make a budget category for it. Figure out how much you need, multiply by 110% as a buffer, and then divide that by the number of months til the event.

If that’s more than you can afford to save each month, figure out either:

- What you can cut from the expenses? Do you really need to fly to Vegas for the bachelorette party? Can you stay with friends instead of in the hotel? Do you need a new dress for the wedding when you have a perfectly fine outfit in your closet? Does anyone actually need a hot pink kitchen aide – or can you at least go in on a gift?

- If you really want to go to this wedding/yoga teacher training/expensive thing you can’t afford, what can you do to earn enough extra money to get there? Can you cut out eating out for a month? Can you pick up some shifts at work an earn a little extra money?

- If neither #1 nor #2 are possible, are you sure you really want to go to this thing? Can you gracefully bow out? Does this thing really represent your core values? If you can’t pay cash for this event, is it really that important to you? Don’t go into debt for someone else’s nuptials or for a conference your work should be paying for because of external guilt.

Also look in your budget for the known unknowns – expensive things that are going to happen in the near- to mid-future but you don’t know when. Do you know your transmission is on its last legs and you’re going to need to spend money to replace it sometime this year? Make a category for it. Don’t get caught unexpectedly without a transmission or the money for a new one. And if it craps out early, at least you have some money set aside instead of nothing to help cover it.

Lastly, anything you pay less than monthly, set up a budget category for it, and stick money in it when you can. Know your monthly goal to stock the category. I have sinking funds set up for my annual renter’s insurance ($140 a year, or $11 per month), my annual half farm share ($250 per year, or $20 per month), bike repair expenses (~$200 per year or $16 per month), haircuts ($55 every 3 months, or $18 per month) , and even my quarterly Co2 refill for my Soda Stream ($11 per every 16 weeks, or $2 a month – hey every bit counts!).

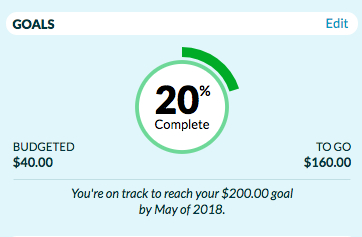

I love that the new YNAB makes it easy to see if I’m on track for a goal- for example, the picture to the left is my $250 annual farm share goal. Some months I don’t prioritize the $20, but I always try to make up the amount I’m behind by the end of the next month (you can see last month I put in ~$8 extra).

I love that the new YNAB makes it easy to see if I’m on track for a goal- for example, the picture to the left is my $250 annual farm share goal. Some months I don’t prioritize the $20, but I always try to make up the amount I’m behind by the end of the next month (you can see last month I put in ~$8 extra).

So when you’re budgeting, make sure that you’re not underestimating those infrequent expenses – school fees, insurance, travel.

Use the budget to give yourself some grace

So maybe you’re going to buy some snacks after a long day at work. Or spend money on eating out when someone’s in the hospital. Or buy new notebooks when you are angry at your boss. Build in those things into the budget, be realistic, and buy yourself a little grace. Plan ahead to be human, because in fact you are.

Hopefully this megapost helps you put together your goals for the new year in your budget. If you’re looking for a budgeting guide, here’s my free quick start budget download.

If you’re looking for a new way to budget, I highly recommend checking out YNAB – you can use this link to get a 34-day free trial, and I’ll get an extra month of YNAB free if you sign up at the end of your trial.