How do you know when to quit a project, a goal, or something similar? And how does a to-do-list role playing game teach you about financial goals?

- Mentioned in this show: Habitica

- The 20 in 2020 Challenges on Oh My Dollar forums

There’s no video version of this episode, but those will be back! The studio camera broke for a week or two.

We’ll continue this discussion on the Oh My Dollar forums, a friendly, nonjudgemental online community about money – come join us, we’re nice! This month we’re doing Snackuary, a food budget challenge, plus kicking off the 20 in 2020 challenges.

Email us any financial worries, successes, or health care questions at questions@ohmydollar.com or tweet us at @anomalily or @ohmydollar.

It’s the OMD Patron Drive! All new Purrsonal Finannce Society Members are Matched

We absolutely love our Purrsonal Finance Society Members, the folks that generously support Oh My Dollar with $1 or more a month on Patreon – and have made is so we have free, full transcripts for every show. Every single new patron this month will be matched! That means your new pledge will be DOUBLED.

This episode was underwritten by patron Tamsen G Association, Chris Giddings, and Warrior Queen. To learn more about being part of the Purrsonal Finance Society and get cool perks like cat stickers, you can visit ohmydollar.com/support

Thank you to all the patrons that have joined during this matching campaign: Rosemary, Chelsea, Denise, Annaleise, Bethany, Mary, Sarah, Kenna, Katherine, Carrie, and Sarah!

Other Episodes You Might Find Interesting

- Making a living as a performing artist without getting famous

- Are perfectionism & procrastination screwing up your finances?

- What money goals should you focus on?

Episodes Transcript (provided by our Patrons)

The Orb of Rebirth and Throwing Old Goals out the Window.mp3 transcript powered by Sonix—the best audio to text transcription service

The Orb of Rebirth and Throwing Old Goals out the Window.mp3 was automatically transcribed by Sonix with the latest audio-to-text algorithms. This transcript may contain errors. Sonix is the best way to convert your audio to text in 2020.

Lillian Karabaic:

Welcome to Oh My Dollar! A personal finance show with a dash of glitter. Dealing with money can be scary and stressful. But here we give practical, friendly advice about money that helps you tackle the financial overwhelm. I’m your host, Lillian Karabaic

Lillian Karabaic:

But first, listeners like you helped keep our lights on. You can join up with other Oh My Dollar! community members to support episode transcripts, server costs and more by making a pledge of a dollar or more per month.

Lillian Karabaic:

And awesome news! This month, a special patron has offered to match every new pledge. That means if you become a new patron before the end of the month, your pledge will be doubled. That means if you pledge $2 per month, it becomes $4 per month. That might not sound like a lot. And hopefully it’s not a lot to you, but it makes a huge difference to the show and actually supports all of our ongoing costs for running the server and the show.

Lillian Karabaic:

Patrons get cool perks like cat stickers and exclusive special badges on our forum. So please check it out. To learn more, you can go to ohmydollar.com/support.

Lillian Karabaic:

This episode was underwritten by patrons Tamsen G Association, Warrior Queen, and Chris Giddings.

Lillian Karabaic:

And welcome to our newest patron this week. Flaki.

Lillian Karabaic:

So one reason I love New Year’s and my birthday is that I love, like the beginning fresh beginnings because I feel like you get this like clean slate to think about new ideas for goals and to dos.

Lillian Karabaic:

And it just feels like you can kind of reset. And this is a very interesting year, I think, because we’re about to go into a new decade and a lot of people are already doing the 10 year challenge 2009 versus 2019.

Lillian Karabaic:

And it’s giving me a lot of time to kind of think about where I’ve come from in the past 10 years and what I really want to look forward going in next 10 years.

Lillian Karabaic:

And part of what’s made me kind of think about this is the “orb of rebirth”. And bear with me, because this is gonna be kind of a long explanation. But I use this to do list software called Habitica. And Habitica is not really a regular to do list software. It’s also kind of a role playing game where as you complete tasks, your little character gets upgrades to their like outfits and their equipment and you find eggs to hatch little tiny magical 8 byte pets.

Lillian Karabaic:

And as you move through the game, and presumably your real life checklist of tasks, you can collect more pets and then you can feed them so they can grow up to become mounts that you can ride. And in the very beginning of using the software. There is a lot of cute new pets to hatch and it’s pretty easy to like get food and gain momentum.

Lillian Karabaic:

And it’s actually quite motivating to have new pets and upgrade your gear. But once you’ve been using it for a long time, I’ve actually been on Habitica I think for like six or seven years.

Lillian Karabaic:

You can start to get to the point where you’ve found almost all the pets you’ve upgraded them all to mounts and it can start to get a little boring or like less motivating. There’s different ways that people kind of interact with this game. But the thing that’s most motivating to me is I want all of the pets and adorable creatures that I possibly can get.

Lillian Karabaic:

And there’s a special badge that you get once you have found 90 pets, which is all of the core pets, you’ve upgraded them to mounts and then you’ve found 90 more of the pets. And once you hit that, a lot of people get completely demotivated because there was this checklist and you worked on it and it took a long time.

Lillian Karabaic:

And then when you finally accomplished it, you go, oh, what now? And Habitica, The thing that you can do is called the orb of rebirth. And what the orb of rebirth does is it lets you keep all of the points because, you know, points kind of matter. It’s a game.

Lillian Karabaic:

But you can essentially get rid of all of your pets. You just set them free and it opens up the keys to your entire stable and all of your pets and your mounts run away and you can go out and try to find them again.

Lillian Karabaic:

And I have recently got to the point where I’ve found all of my core pets and mounts and found them again and was kind of contemplating if I wanted to open up the keys to my stable in happy tica, because largely one of the things that motivates me to check things off my task list and to keep going and to keep engaging with this to do list software was that I get to upgrade all of these pets and I am working towards this very concrete goal. And I think this actually comes back around to see. Bear with me, I know we’re a personal finance show and not a show about tiny little 8 bit pets, but when I am kind of thinking about if I want to do this orb of rebirths in the game, I’m also thinking about the fact that like we’re about to have a new decade and it’s very easy to set the same New Year’s resolutions and kind of go with the same financial goals that you’ve always done. A lot of financial goals take hugely long amounts of time. Like obviously saving for retirement is something you’re doing your entire working career. Up until retirement, paying off student loans can take 10 or even 20 years. And it’s one of those things that it can get really easy to get stuck in ruts about how you think about goals with your money.

Lillian Karabaic:

And I think one of the advantages of approaching New Years, kind of like you approach the orb of rebirth in Habitica is that you can think of it as a total clean slate. You can get very inventive. Sometimes I do this with my budget where it’s easy to just say, oh, I’ve always been spending this much on groceries, this every month and this much of my gym and this much on my phone.

Lillian Karabaic:

And I think sometimes it can get really creative to actually wipe everything clean and then go. “Let’s assume. Not a single dollar that I have has a job and it’s not going anywhere. What would it look like to rebuild this from scratch?”.

Lillian Karabaic:

Because I think it’s easy to – because progress is such a big part of financial goals. You know, checking off as you pay off new debts or watching your savings grow, it can get really easy to get focused on the progress and totally forget about the creativity of building something new. And I think this can be really helpful when you’re approaching kind of creating new financial goals for yourself. So one of the like best parts about Habitica. Yes, I am bringing it back to this weird to do list habit RPG that I play, but there’s one really other helpful element and Habitica – which is that to get the super special magical creatures, you actually have to go on quests. And the quests are mostly you do your to do list.

Lillian Karabaic:

You’re just kind of enrolled in them, but you cannot quest by yourself.

Lillian Karabaic:

You have to actually join a party. And this party is made of other real people that are also working on their to do lists. And one thing that I know is that when I don’t do things on my to do list, my entire party gets damage.

Lillian Karabaic:

Everyone gets hurt on my entire party. If I don’t, you know, pretty often clean out the sink of my dishes at the end of the night, or if I don’t actually send out my update to all of my patrons, then that to do list goes red and it hurts my entire party.

Lillian Karabaic:

And I think that the party aspect is one of the hardest parts. If you are working on your finances by yourself, either you’re financially separate from a partner, You don’t have a partner and you’re independent from, you know, whatever your family of origin is. It can get really hard to – Feel like things matter, right?

Lillian Karabaic:

Especially in the current world we live in. It can get really. It can feel very selfish to care about financial goals like progress simply because you don’t kind of have the rallying instinct that comes with these kind of longer term goals like paying off student loans, stuff that’s slow to progress.

Lillian Karabaic:

And I think one of the most important things for me in working on my financial goals – as someone who is working on them independently – was finding community, and the goal of community with financial goals isn’t necessarily that you share your financial woes with them or when you take damage, they take damage.

Lillian Karabaic:

But it turns out having other people that you feel like are supporting you as you work on something that’s slow can be extremely helpful. And my finances changed dramatically for the better when I started interacting in an online community, which now for me is the oh my dollar online community.

Lillian Karabaic:

Even when I first started interacting, it was this BBForum online for people that were fans of this early retirement blog. But not only did that community become a lot of my real life friends. Originally I was entirely anonymously just keeping a journal of my progress.

Lillian Karabaic:

And what it felt like was that I had this external accountability to something that people don’t tend to talk about a lot. Right? It’s really – I as someone who makes my personal finances public every single month now. I have discovered the blowback you get when you try to say, hey, I paid off my student loans. If you post on Facebook or on Twitter about like, hey, this month I was able to save 30 percent or 40 percent of my income.

Lillian Karabaic:

People take it as bragging or as humble bragging or they want to tell you why they can’t do it.

Lillian Karabaic:

And it can be one of those things where we have so much social baggage about talking about finances built up that it can feel harder to share this in a community of people that, you know in real life, because people take it as an affront to their own, you know – where they’re at with their own finances.

Lillian Karabaic:

They see it reflected back at themselves. If you are having success or even if you’re having struggles, they feel like it’s whining or something like that.

Lillian Karabaic:

But if you go to a find a safe place and a safe community to talk about these things, even if it’s anonymous. What for me that did was that it made it a lot easier to feel like focusing on it was important and wasn’t selfish.

Lillian Karabaic:

It was rather a thing that I was doing because I saw a lot of other people working on similar goals and the accountability I found was helpful for other people. I think one of the great parts about being involved in that community early for me was that people tended to skew higher income on that online community. And I had what I felt like was a pretty high incomw when I started on there, I was making $30000 a year, which was a lot more than I had made at any other point in my life.

Lillian Karabaic:

And then eventually I was making thirty nine thousand. But the average person on that forum was making more than six figures. And one of the things that I felt like I actually brought was that I was able to show what financial choices around kind of early retirement and high savings rate looks like when you were making what I was making.

Lillian Karabaic:

I think my actual first journal title on that forum was “less than 40K is perfectly OK.” But it also helped me completely shift my perspective because I saw, what dealing with money looked like for people that came from entirely different circumstances, what it looked like when you lived in a country where you didn’t have to worry about getting bankrupt, you know, because of a medical bill, what it looked like for people that absolutely are not worried about covering their core bills. But instead, everything they’re doing is around tax optimization.

Lillian Karabaic:

And actually being able to talk about money with people that had diverse monetary experiences opened my eyes to totally new goals, because often the only people that you talk about finances with are either your extremely close friends, family members that come from the same circumstances as you or – depending on the kind of workplace. Maybe people that make the same as you.

Lillian Karabaic:

So, you know, if especially if you work like in service industry, it’s very common to kind of talk about money. But everybody’s making often kind of similarly low level wages. And it gets you trapped in thinking about your goals and your finances from within these really limiting contexts. And for me, the first time that I heard that you could actually save half your income, it was very eye-opening to me because I didn’t know anybody like that in my real life, because I didn’t know anybody who made the kind of money where I felt like that was even possible.

Lillian Karabaic:

You know, I knew a lot of people that were extremely proud that, you know, they managed to actually call their student loan providers and find out if, if and when they owed student loans. Like that was the level of financial accomplishment that most of my peers had, let alone, or that they like, you know, filed their taxes two years late.

Lillian Karabaic:

But then I started meeting people that, you know, had retired in their late thirties. And it just shifted my perspective. And this is a very long way of coming around to saying, I think when you’re looking at goals for the New Year, there’s very helpful things to look at. One is looking at building up a community of support where you can actually talk about financial goals. And, you know, I’ve found it very helpful in the oh my dollar! online community. Not at all pressuring you to join that. But I think if you’re not able to openly talk or track money with anyone in your life, it’s really hard to get ahead with it because open conversations about money, even if it’s not to everybody but to someone in your life, will help you make it feel like it’s real.

Lillian Karabaic:

Because honestly, for a lot of us, this is just numbers moving around on a screen. Right?

Lillian Karabaic:

And then the next thing is thinking extremely creatively. So, you know, I like to look at the new year as a time to completely reset and wipe clean. And maybe you were wildly successful at your goals in twenty nineteen and are totally ready to enter a new decade. And you’re stoked and you’re just going to continue what you were working on this year, next year. But maybe you’re like me, you had a bunch of goals that you made kind of steady progress on, and then quite a few that you fizzled progress on entirely.

Lillian Karabaic:

I like to look at January 1st or really any day that you get the fire under your butt if you’re listening to this. Not at the end of the year. It’s OK. There’s nothing magical about the start of the new year.

Lillian Karabaic:

But I like to look at is it a time to, like, completely rethink your goals!

Lillian Karabaic:

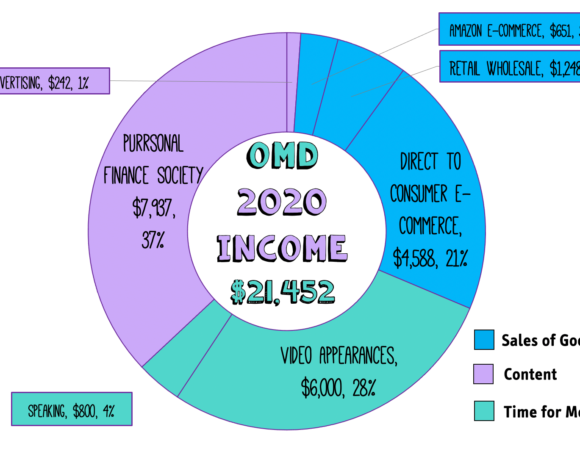

I think there’s actual real value in like tapping into that orb of rebirth and just using it as a magical day to say, OK, what does it look like if I completely change what I’m working on? So one thing that I did is that in twenty nineteen, my goal was completely different than previous years. So previously I really focused on my savings rate and how much I put aside for retirement.

Lillian Karabaic:

And last year, you know, I had I think a thirty six, thirty six or thirty seven percent savings rate. It depends on how you calculate it. We should have an episode on calculating savings rates. Let me know if you’re interested in hearing that. Because there’s lots of different ways to do it!

Lillian Karabaic:

And then previous years to that I’d had a 50 percent savings rate and one year I got up to 55 percent savings rate and I’d focused so much on my savings rates and how I saved up for it.

Lillian Karabaic:

And this year, my goal was simply to come out ahead. That was my only stated financial goal this year. I wanted to focus on oh my dollar! and not spend all of my time working other jobs to pay the bills. So. And distracting me from the stuff that I want to make for oh my dollar. I wanted to just make media projects. You know, it was OK if I didn’t save any money this year. So I didn’t set any ambitious saving goals like years past. All I did was set my retirement savings on autopilot at one hundred per month, which is not my usual goal, to be clear, much lower.

Lillian Karabaic:

But I you know, I knew I wanted to keep saving because it would lower my taxable income because it’s in a traditional IRA. But I didn’t want to do more than that. And I accomplished it. I did that.

Lillian Karabaic:

I came out slightly ahead. I saved slightly for retirement. My net worth pretty much didn’t climb from last year. Other than how the market went up. So I didn’t ramp up my retirement or my savings rate. And now I did it.

Lillian Karabaic:

I did it in twenty nineteen. I completed the challenge of only working for myself for an entire year. And I completely renewed my goals. Next year I’m going in a completely opposite direction.

Lillian Karabaic:

And for me, this was a year is a lot of time to accomplish something or test something out. I think one of the best pieces of advice I’ve ever heard about goal setting is – a year from now you will of wish you had started today.

Lillian Karabaic:

And I think when you get really caught up in things like long range planning, like paying off debt or saving for retirement or something like that, it can be really hard to feel like a year can make progress, but a year can make progress on a bunch of different things.

Lillian Karabaic:

So one of the things we’re doing on the Oh My Dollar! forum is that we’re doing a 20 in 2020 challenge and we ended up having five different- Choose your own adventure challenges. And they’re kind of broken along income lines, but also just where people are at in their life. So the 20 in 2020 challenge that initially I started was saving 20 percent of my income, because for a lot of people that’s a lot more than they’ve ever saved.

Lillian Karabaic:

20 percent is a huge accomplishment. It’s more than what I kind of say is the standard amount that you need to save towards retirement, which is roughly 15 percent, if you want to retire at normal retirement age.

Lillian Karabaic:

But saving 20 percent of your income, it’s less than I’d saved before. But then there’s a push challenge and that is for people either with higher incomes or people like me that are lucky enough to be in the situation where if they they know how to reduce their expenses, even if they’re on kind of a lower income to really push up savings. And so the next one we have is 20 in 2020- Save $20,000 challenge.

Lillian Karabaic:

And there’s some people that already are automatically going to hit that because they make a lot more money than me. And that’s just sort of their standard practice. And there’s people like me for which that’s going to be really a push. And then there is the- If both of those sound absolutely ridiculous and don’t fit your goals this year. There is the save $20 a week challenge. And I think saving $20 a week is a great example of like based on what your priorities are. It is an easy way to get yourself in the habit of savings and feel really proud of yourself.

Lillian Karabaic:

And we also have the if the – 20000 isn’t hard enough for you, we have the race to the Max challenge, which is racing to max out your retirement accounts. If there are 401K, a super, a pension, whatever, you have access to – RRSP.

Lillian Karabaic:

And last but not least, my favorite and I think the place where you can get most creative with your financial goals is the bingo challenge where you actually create your own bingo board and you get a little badge every time you hit bingo. And so you have 24 goals. You can add some free spaces or repeat goals if you want.

Lillian Karabaic:

And I think the push of having twenty four goals that fit on a bingo board that you don’t have to wait the entire year to accomplish – Like a percentage or saving a huge amount of money- Is that it kind of give you those small wins and it lets you think creatively for some people. It might just be “bake A really nice cake” is one of the things on their board.

Lillian Karabaic:

And when you’re thinking about financial goals, I think it’s helpful to take that orb of rebirth and go. “If I was not thinking about what I’ve done in the past and instead just looking at my current financials situation and going for a blank slate, what is the thing that I want to focus on this year?

Lillian Karabaic:

A couple of things when you’re thinking about setting financial goals, which I do think are really helpful, I think it’s hard to make progress on your finances without at least some sort of goals.

Lillian Karabaic:

You can set them on autopilot, but you still need kind of an idea of where you’re going. Things to think about when you’re setting them. Where do you want to be when you’re 80 years old? What would you like to be remembered for? That can be helpful when you’re thinking about, you know, future stability. And then what goals would help you get there?

Lillian Karabaic:

I like to think about where I can use money to solve my problems. So, you know, sometimes spending a little bit more money can eliminate a huge source of stress in my life. You know, getting an extra set of towels so that I’m not rushing to try to do laundry because – for ages I only had one towel, and it turns out like it’s very annoying to have to wait to take a shower, to go to a laundromat and do an entire load of laundry.

Lillian Karabaic:

And buying a set of towels is not that expensive. So just what are the little annoyances in your life? A non sharp knife or the fact that you continually pay an annoying overdraft fee on one of your accounts because you don’t leave a buffer in there or you pay a monthly fee on your checking account because you’ve failed to, you know, make sure you get 8 A.T.M. transactions each month. Maybe you just need to move to a different bank.

Lillian Karabaic:

Those kind of like little things that you can do that can eliminate annoyances in your life.

Lillian Karabaic:

So, this is a long and winding show about kind of setting goals, but I would like to encourage you to look at whatever – the day that you’re listening on this, the next time you sit around and think about your financial goals and think about it as though you have hit the orb of rebirth, you are retaining all of the points that you have.

Lillian Karabaic:

You still have the same net worth. You still have the same debt But you get a completely reset, what you’re focusing on and what you’re working on. Don’t just go for the status quo goals because you feel like that’s the only way to accomplish the end goal.

Lillian Karabaic:

You know, this year, one of the ways that I accomplish the end goal was by focusing on creating things that had long-lasting impact. But we’re going to hurt my overall savings rate. But I knew that in other years I could ramp up my savings rate. So I’d love to hear what your big goals are for next year or even for, you know, whatever you hear this episode, if you hear it later.

Lillian Karabaic:

And if you’re interested in participating in the 20 for 2020 challenges, you get cute stickers and also a community to support you as you work on things. You can always check them out on the Oh My Dollar! forums.

Lillian Karabaic:

But that wraps our show for today. I’d love to hear about your financial goals, your worries, your successes. You can e-mail us at questions@ohmydollar.com or you can tweet us @anomalily or @ohmydollar. Oh My Dollar is recorded XRAY.FM studios in Portland, Oregon and syndicated through PRX. This episode was engineered by Tony Scholl and Chase Spross. Our Intro Music is by Aaron Parecki.

Lillian Karabaic:

And thanks for listening.

Lillian Karabaic:

Remember til next time to manage your money so it doesn’t manage you.

Quickly and accurately convert audio to text with Sonix.

Sonix uses cutting-edge artificial intelligence to convert your mp3 files to text.

Thousands of researchers and podcasters use Sonix to automatically transcribe their audio files (*.mp3). Easily convert your mp3 file to text or docx to make your media content more accessible to listeners.

Sonix is the best online audio transcription software in 2020—it’s fast, easy, and affordable.

If you are looking for a great way to convert your mp3 to text, try Sonix today.

This was delightful. I love taking the Orb of Rebirth as inspiration for a complete reset of goals (and I really like the idea of “if you started this all out from scratch, without any current goals, what would it look like?” – that’s something I don’t do often enough).

I love taking the Orb of Rebirth as inspiration for a complete reset of goals (and I really like the idea of “if you started this all out from scratch, without any current goals, what would it look like?” – that’s something I don’t do often enough).

I really loved this episode! Thanks for taking us through your personal journey with the PF community.

I like the orb of rebirth idea. I started the new year unemployed for the first time in my life, so I think I’ll be using the orb of rebirth to allow myself to focus on just keeping afloat until I get a new job, and then do another rebirth after I get a new job. It’s hard to keep long term financial goals when I don’t know how long the job search will take.

This is really interesting framing. Since I’m keeping all the points, because I’ve worked to get them. But now what is motivating? Anyways, no solution, but helpful ideas to maybe jostle the brain out of its rut.