When you’re an employee, you’re also an employee with health needs. How do you balance both? We talk with Mac Prichard about how to bring up health care in the job process, and how to negotiate for sick leave without “outing” yourself. Plus, what your rights are for leave in the US and when it kicks in. Should you get COBRA? And more!

Special thanks to Mac Prichard of Mac’s List who added his expertise to this show. Mac’s List has a great job advice podcast, Find Your Dream Job, here!

This is our second ever video version of the podcast, and we still have a lot to learn! But I am wearing a cape, so there.

We’ll continue this discussion on the Oh My Dollar forums, a friendly, nonjudgemental online community about money – come join us, we’re nice! This month we’re doing Get it Done December, and it’s not too late to join and get your final to-do’s done and get a free cat sticker for it!

Email us any financial worries, successes, or health care questions at questions@ohmydollar.com or tweet us at @anomalily or @ohmydollar.

A Cat’s Guide To Money – Oh My Dollar! cat-filled purrsonal finance book, is shipping now. You can order a copy now for delivery for end-of-year gifts (plus other cute OMD merch) at the Oh My Dollar! Shop.

This show is made paw-sible by listeners like you

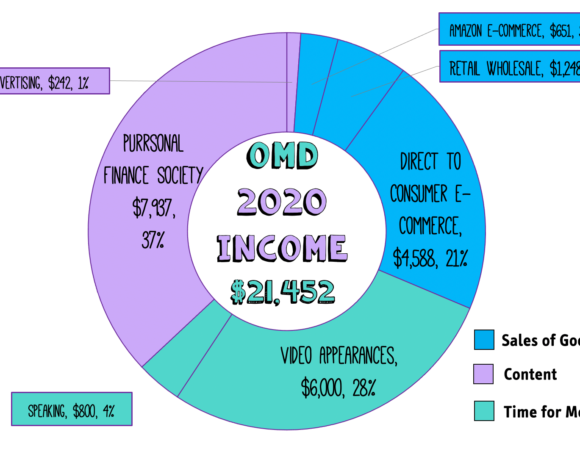

We absolutely love our Purrsonal Finance Society Members, the folks that generously support Oh My Dollar with $1 or more a month on Patreon – and have made is so we have free, full transcripts for every show. This episode was underwritten by patron Tamsen G Association, Chris Giddings, and Warrior Queen. To learn more about being part of the Purrsonal Finance Society and get cool perks like cat stickers, you can visit ohmydollar.com/support

Other Episodes You Might Find Interesting

- What the heck is a co-pay vs co-insurance?

- Are Health Savings Accounts an evil Republican tax loophole or actual magic?

- Open Enrollment is like playing Dungeons & Dragons… with a drunk dungeon master

- Save money on dental – with or without insurance

Full Show Transcript (provided by our patrons)

Balancing Being a Human and an Employee (Health).mp3 transcript powered by Sonix—the best audio to text transcription service

Balancing Being a Human and an Employee (Health).mp3 was automatically transcribed by Sonix with the latest audio-to-text algorithms. This transcript may contain errors. Sonix is the best way to convert your audio to text in 2019.

Lillian Karabaic:

This episode was underwritten by the Tamsen G Association, Warrior Queen and Chris Giddings – to learn more, you can visit ohmydollar.com/support.

Lillian Karabaic:

Welcome to Oh My Dollar!, a personal finance show with a dash of glitter. Dealing with money can be scary and stressful. Here we give friendly advice about money that helps tackle the financial overwhelm.

Lillian Karabaic:

I’m your host, Lilian Karabaic, and its health care month! This week, We’re back with our hot, hot health care month content.

Lillian Karabaic:

Researching American health care, the thing that makes me not want to get out of bed in the morning. Today we’re talking about that fun intersection of getting health care and trying to keep or get a job.

Lillian Karabaic:

In the United States, health care is provided by the more majority of people through their employers. But even outside the U.S., your health has a big effect on your livelihood. How do you balance being an employee and being a human with actual medical needs? Like most humans.

Lillian Karabaic:

It’s easier when you’re job hunting to just say, “oh, health insurance provided” and assume it will be fine. But how do you actually size up and evaluate the health care package?

Lillian Karabaic:

What if it’s not good, but you still want the job?

Lillian Karabaic:

If you need specific health care, cancer screenings, insulin, biological, PREP, how do you bring it up in the job negotiation process without “outing” yourself?

Lillian Karabaic:

Mac Prichard, with Mac’s List, a job listing, service and career cancelling company, said it’s very normal to get further details on the health insurance – once you have a job offer in hand. He emphasized that the time to have a discussion is when a job offer is on the table; not before that point.

Lillian Karabaic:

Most negotiating power that you have is once you have a job offer in hand.

Mac Prichard:

It’s normal to talk to an employer about health care benefits once a job offer is on the table. You need to remember two things. One, don’t talk and ask about benefits in a detailed way until you have that offer, because that’s when you’re most attractive to an employer. And that’s when these conversations typically take place.

Mac Prichard:

The second thing to remember is – it is okay to ask lots of questions, to ask to see about the start date of coverage, about the cost, and about the exact benefits.

Lillian Karabaic:

In my case, when I needed to know if the health insurance plan would cover my drug, I asked during the salary negotiation call for the specific plan names, so that I was able to look up details on my own about the plan online.

Lillian Karabaic:

This gave me information on the co-pays, ability to look up coverage benefits and look up the formulary to see if my drug was covered. It wasn’t an option for me to take the job if my drug wasn’t covered – because it’s really expensive.

Lillian Karabaic:

If there’s only one plan available and it doesn’t cover the kinds of things you need, the plan the employer gets probably won’t change. Even at small companies, these things are set up and negotiated in an annual contract with a health insurance company.

Lillian Karabaic:

However, there might be other ways an employer can change your compensation package. Employers usually pick up 50 to 80 percent of the premium. If you know you’re going to have large out-of-pocket costs, you can go back to the employer and ask them to consider increasing their contributions.

Lillian Karabaic:

Or you can ask them to increase your compensation to cover the difference in your out-of-pocket contribution. You may be able to ask them not to cover you under the plan if they can legally exclude access, so that you can get a plan on your own through the exchange.

Lillian Karabaic:

You don’t need to disclose any of your medical conditions to the employer in order to learn about the plan, and the benefits. This is a very normal conversation to have in the salary negotiation process.

Lillian Karabaic:

It’s also important to note when coverage begins, you may have costs because of gaps of coverage.

Lillian Karabaic:

Many employers don’t begin health insurance benefits until 30, 90 or sometimes even one year after employment. In that case, it’s important to weigh the costs that you’ll have getting your own coverage until that coverage kicks in.

Lillian Karabaic:

In the interim, you can either get coverage through the state’s exchange or by extending your current coverage through COBRA. But note that COBRA is a relic of the old system and it is a lot more expensive usually than getting a plan on the state’s exchange. It has very high essentially costs that they charge just for the administration of the plan.

Lillian Karabaic:

So what happens if you end up sick when you’re already working or your health situation changes? If you have something like a communicable illness, like flu or whopping cough, it’s possible that it’s not even legal for you to work. But there are a number of sicknesses that are not communicable, including mental health, that might cause you to miss or need to reduce work.

Lillian Karabaic:

If your health situation changes and say you’re working a full time job with frequent travel and you need to start working remotely from home – you may have to ask to change positions within your company.

Lillian Karabaic:

If there’s not a possibility of changing or adapting the position, then you need to figure out a way to negotiate some time off. In the U.S., all firms and public employees and schools are required to have FMLA in place if they have more than 50 employees, which is called Family Medical Leave Act.

Lillian Karabaic:

With FMLA in place, the Family Medical Leave Act, this allows you to take 12 weeks of unpaid time off for the birth or adoption of a child or your own health needs.

Lillian Karabaic:

The big thing here is that you have to be able to keep your group health insurance plan and your job has to be protected. The other thing to know about FMLA is that it doesn’t have to be continuous.

Lillian Karabaic:

Great thing about FMLA is that you can use some of that time in, you know, one day at a week or you could use it to leave early. The big thing to know about those 50 employees that are required for FMLA is that seasonal employees count.

Lillian Karabaic:

So I worked at a small nonprofit, but it turned out that because we had seasonal employees, we actually did qualify for FMLA. The thing about these twelve weeks is that it doesn’t have to be consecutive. If you need to work a part time schedule, you can get FMLA days to work half days or one day a week off.

Lillian Karabaic:

Lady Duck on the forums said she had dysmenorrhea, which is painful periods when she first started working and had to take essentially one day off a month. She said “I didn’t know all the questions to ask at the time of hiring, but it was still scary when I had to go to my manager after I realized I was going to need regular but slightly unpredictable days off work. Then I had to have the conversation all over again after I was diagnosed with anxiety and I could not work full time, I definitely looked up as much as I could about their H.R. systems before taking it to my boss.”.

Lillian Karabaic:

Listener S wrote in with a question that’s even more complicated. She says.

Lillian Karabaic:

“I work for a small company of eight employees where the owner is very involved day to day. Recently, the owner mentioned, in passing, during lunch that the company may get rid of health insurance coverage next year since it’s getting too expensive. She explicitly mentioned that she could get covered on her partners’ insurance, and was trying to figure out that if it was legal consequences to dropping health insurance for all of her employees.”

Lillian Karabaic:

“She has a history of changing people’s hours or company policy around PTO sick time based on her own whims. And I’m concerned I won’t even get enough notice if this really does happen.”.

Lillian Karabaic:

“I’m trying not to freak out, but I need my health insurance coverage as I’m a breast cancer survivor. But I don’t know how to have the conversation with my boss about this. I actually like my job and it’s hard to find work in my field. But Human Resources has never been my boss’s strong suit. I have a good working relationship with her, but she tends to get offended whenever someone brings up something like paid time off OSHA or health care. How do I broach this?”

Lillian Karabaic:

S, I’m sorry to say this is definitely going to be an awkward and not fun conversation. My advice, quite simply, though is to tackle the awkwardness head-on because there is a lot that’s about to come up if you do lose, your health insurance.

Lillian Karabaic:

Might as well be awkward to either prevent that or confront it, ahead of time. Bring up to your boss. “I heard you might be eliminating health insurance, since this would have a big impact. I hope that you would give us a lot of notice.”.

Lillian Karabaic:

Since you do say you get along well with your boss, you should remind her that health insurance is a big factor for a lot of people in deciding to pick a job. And I know you said you like this job, but I don’t know. This job sounds maybe not ideal. Is there a possibility that you can get another job?

Lillian Karabaic:

If it’s rising costs that your employer is worried about, you might be able to actually get your employer to give you what’s called a “health care stipend.” And this is something that she can give you where you can go get coverage on your own. And it would stabilize the costs, essentially eliminate that human resource cost of having to figure out a new plan each year to cover employees. And she can actually do this with tax free money, depending on how she’s structured.

Lillian Karabaic:

But most corporations or LLC would be able to do this with tax exempt money for their employees. And this might be something that you could bring up to her as an alternative plan.

Lillian Karabaic:

You could also say, oh, maybe I can help with researching plans. It’s a big deal to lose your health insurance, though. And you should make sure to accurately represent to her that that would be seen as taking a pay cut for everyone, because it’s a large part of your compensation package.

Lillian Karabaic:

Well, S, I hope that helps.

Lillian Karabaic:

Oh My Dollar! is supported by listeners like you through our patreon, also known as the Purrsonal Finance Society. Folks at pledge $1 or more per month get stickers and perks on our forum. You can find out more at ohmydollar.com/support.

Lillian Karabaic:

Time for our new segment. Why is American health care so frickin broken?

Lillian Karabaic:

In a story reported by Kaiser Health News, Patients who should be eligible for free or discounted health care instead have been sent over $2.7 billion in bills by nonprofit hospitals, leaving many low income people into medical bankruptcy under the Affordable Care Act.

Lillian Karabaic:

Nonprofit hospitals are mandated to provide free or discounted emergency care to patients with low incomes. Nonprofit hospitals that do not provide so-called “charity care” risk losing tax exempt status. But in a survey of over 1000 hospitals with nonprofit statuses, Kaiser Health News found that 45 percent of them were sending medical bills to patients whose incomes are low enough to qualify for charity care.

Lillian Karabaic:

These hospitals have $2.7 billion in collective written-off debt sent to patients whose income would have qualified them for financial assistance.

Lillian Karabaic:

Fifty six percent of American community hospitals have this nonprofit status, which excludes them from paying most taxes and allows them to have access to tax exempt bonds for things like building new hospitals.

Lillian Karabaic:

One study found that Americans had 81 billion in medically-related collections in 2016, forcing many into bankruptcy. In one lawsuit against St. Joseph’s Hospital, it was found that workers were told never to voluntarily offer patients a financial assistance application.

Lillian Karabaic:

If patients did ask for one, workers were instructed to ask for deposit at least three times. Over half the applications that were submitted were rejected, due to a large amount of required documentation.

Lillian Karabaic:

One patient at St. Joseph recalled that the financial assistance application was so complicated it asked the make and model of her car.

Lillian Karabaic:

In the case where applications were successful, E.R. doctors frequently have their own practice group and are not required to follow the hospital’s financial assistance policy, leaving many patients on the hook for tens of thousands of dollars, even after a successful financial application.

Lillian Karabaic:

Former employee Rachel Murphy said “It became this money making system. People would be crying at the registration desks. People would be upset. People would walk out.”

Lillian Karabaic:

That was our depressing health care news story this week.

Lillian Karabaic:

It’s real great, we live in a great country.

Lillian Karabaic:

Well, I think that wraps our show for today. We love hearing from you. E-mail us your financial worries, successes or any health care questions you have at questions@ohmydollar.com or tweet us at @anomalily or at @ohmydollar

Lillian Karabaic:

Oh My Dollar! is recorded at the XRAYFM Studios in Portland, Oregon and syndicated through PRX. This episode was engineered by Tony Scholl. Our videographers is Chase Spross, our intro Music is by Aaron Parecki.

Lillian Karabaic:

And I’m your host, Lillian Karabaic. Thanks for listening. Until next time, remember to manage your money so it doesn’t manage you.

Quickly and accurately convert audio to text with Sonix.

Sonix uses cutting-edge artificial intelligence to convert your mp3 files to text.

Thousands of researchers and podcasters use Sonix to automatically transcribe their audio files (*.mp3). Easily convert your mp3 file to text or docx to make your media content more accessible to listeners.

Sonix is the best online audio transcription software in 2019—it’s fast, easy, and affordable.

If you are looking for a great way to convert your mp3 to text, try Sonix today.

If you live in Washington state, look at the Paid FMLA which is being made available in 2020. I’ll update my post when I get to work, but it’s essentially a new deduction most folks will see on their wage stubs, similar to social security and worker’s comp. We pay into the system and can opt to receive up to 2/3 our wages during a time we’re not working and using FMLA.

Edit: Here’s the overview:

I’m on mobile so my editing skills aren’t very strong here. Essentially Washington employers began paying in to the system in January 2019. If you worked 820 hours between Jan 2019 and Jan 2020 (16 hours/week for the full year), you’re eligible.

Weekly earnings through PFMLA max at $1000, and they’re based on a percentage of your earnings.

Not the same as PTO, but definitely better than leave without pay.

It’s just like EI!

EI?

https://www.canada.ca/en/employment-social-development/programs/ei.html