We talk about:

- Leading by example

- Focusing the conversation on values instead of shame

- Talking about money with a co-parent that you’re not romantically involved with

- Anarcho-punk roommates who pay rent in cash

- Paying the tab for the entire bar (really, we do!)

We love hearing from you!

Email us your financial worries or cat pictures or your retail therapy indulgences at questions@ohmydollar.com or tweet us at @anomalily or @ohmydollar

You can always find me on the Oh My Dollar! forums, a friendly, nonjudgemental online community about money. Don’t be afraid, come join us on the forums!

A Cat’s Guide To Money – Oh My Dollar! cat-filled purrsonal finance book, is shipping next month. You can pre-order a copy now if you missed the kickstarter! (Plus new stickers and a planner!)

This show is made paw-sible by listeners like you

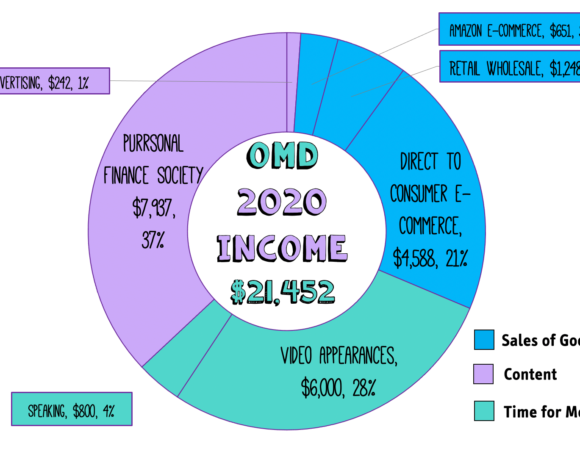

We absolutely love our Purrsonal Finance Society Members, the folks that generously support Oh My Dollar with $1 or more a month on Patreon – and have made is so we have free, full transcripts for every show.

This episode was underwritten by patron Tamsen G Association and Warrior Queen. To learn more about being part of the Purrsonal Finance Society and get cool perks like cat stickers, you can visit ohmydollar.com/support

Other Episodes You Might Find interesting

- Curbing Impulse Purchases and Regrettable Spending

- How much should you budget for clothing?

- What items are worth splurging on?

- Money when depressed

Transcript (provided by our listener supporters on Patreon)

Will Romey: [00:00:00.18] This show is supported by generous listeners like you. Yes, you! through our Patreon. This [00:00:05.0] episode is under the Tamsen G Association, Warrior Queen and Chris Giddings. To learn more about ways to support Oh My Dollar! and get cool perks [00:00:10.0] like cat stickers and a fancy special icon [00:00:15.0] on our forums. You can visit ohmydollar.com/support/

Lillian Karabaic: [00:00:19.62] Welcome [00:00:20.0] to Oh my dollar!, A personal finance show with a dash of glitter. Dealing with money can be scary and stressful. Here [00:00:25.0] we give practical, friendly advice about money that helps you tackle the financial overwhelm. I’m your host [00:00:30.0] Lillian Karabaic

Will Romey: [00:00:31.74] I’m your other host, Will!

Lillian Karabaic: [00:00:34.35] So the [00:00:35.0] other day I was teaching a workshop on personal finance and one of the [00:00:40.0] students came up to me afterwards, and said like, “how do I [00:00:45.0] get my partner to stop spending all of the money?” [00:00:50.0]

Lillian Karabaic: [00:00:51.15] And this is one of those things that I think comes up really often [00:00:55.0] when you first start talking about like getting your money together. This student, in particular was like, I’ve [00:01:00.0] been behind on rent and bills for a couple months, but I just got a job and I’m like, catching [00:01:05.0] up.

Lillian Karabaic: [00:01:05.04] But, one of the big problems that I have is just that my partner is like always wants to go to the bar [00:01:10.0] and always wants to spend money eating out and doesn’t really like understand [00:01:15.0] that that can’t be the thing I do right now.

Lillian Karabaic: [00:01:17.43] And it’s such a slippery slope when [00:01:20.0] your romantic partner is – not *really* [00:01:25.0] on board with getting money together side of things, when you are [00:01:30.0] like motivated and fired up, just start getting things together.

Lillian Karabaic: [00:01:33.48] And that could be like early [00:01:35.0] in the stages, where you’re just starting budgeting. But it can also be like later on when it turns out like, you know, [00:01:40.0] you want to do a renovation on your house and one person’s on board and the other is not.

Lillian Karabaic: [00:01:44.16] Like so many [00:01:45.0] conversations that we have with our significant other are kind of conversations about [00:01:50.0] money, which, of course, as we know on the show, are always really just a conversation about values.

Will Romey: [00:01:55.72] Yeah. [00:01:55.0]

Lillian Karabaic: [00:01:56.68] And obviously the best case scenario is that your partner wants to get a handle on your [00:02:00.0] money just the same as you.

Will Romey: [00:02:02.43] Best case scenario, you both want to do it and you can work on that together.

Lillian Karabaic: [00:02:04.25] Right! But [00:02:05.0] that doesn’t mean that there isn’t still like going to be conflict and conversations. But let’s [00:02:10.0] say, like, one of you is really excited about it and you’re trying to like start [00:02:15.0] budgeting together, blah, blah, blah, but the other is just totally not into it. If [00:02:20.0] your partner is resistance to making a change – My biggest advice and advice [00:02:25.0] that I’ve seen a lot of other people that have kind of like brought their partner around – is the lead [00:02:30.0] by example.

Lillian Karabaic: [00:02:32.28] Which is just leave them out of like starting [00:02:35.0] budgeting and doing the saving and just lead by example. Like remember, that they’re dealing [00:02:40.0] with money scripts and like internal feelings about money just like you are. [00:02:45.0]

Will Romey: [00:02:45.09] And they’ll see you succeeding at these things and want to be like that.

Lillian Karabaic: [00:02:49.08] Right. And so like [00:02:50.0] you can work on yourself, right? It’s like it’s the airplane thing. Put your mask [00:02:55.0] on yourself, before before your partner.

Lillian Karabaic: [00:02:59.36] And I [00:03:00.0] think it’s really helpful, because I think even at the even if you’re like your finances aren’t [00:03:05.0] commingled with your partner. Obviously, this is a little easier if you’re not –

Will Romey: [00:03:08.58] Right, because it’s just up to you!

Lillian Karabaic: [00:03:08.79] If [00:03:10.0] you live with them and you’re mostly separate like it, it helps for you because they’re like, oh, they’ll [00:03:15.0] start to see you like get control of this and be like, oh, I especially [00:03:20.0] if they’re like a complete disaster with money- which I know quite a few people like that.

Lillian Karabaic: [00:03:24.15] I’d be like, oh, I want [00:03:25.0] that. I want that feeling of peace with my money and start to see it.

Lillian Karabaic: [00:03:29.82] And just [00:03:30.0] like seeing kind of the way that you’re handling it, like, oh, they’re sitting down to [00:03:35.0] budget every Sunday night or oh, like I actually see them like entering [00:03:40.0] transactions or making the decision to close their tab at the bar when they like have [00:03:45.0] hit their limit.

Lillian Karabaic: [00:03:45.87] You know, those those kind of things can just start to to [00:03:50.0] make a difference. And there’s a lot of things that usually are within your control, unless [00:03:55.0] you are like always 100 percent of the time with your partner.

Lillian Karabaic: [00:03:57.99] So like, do you bring lunch to [00:04:00.0] work? That’s probably something within your control. It’s something that you can choose to do yourself.

Will Romey: [00:04:04.6] It would be [00:04:05.0] like less pressured by by by their inclusion to do differently.

Lillian Karabaic: [00:04:08.61] So and then like the [00:04:10.0] automatic savings is one of those things that I think is really powerful, [00:04:15.0] especially if you’re like starting to get that ahead.

Lillian Karabaic: [00:04:16.71] And, you know, that’s the thing that you’re in control of. You can [00:04:20.0] you can start amping up that savings and paying yourself first without [00:04:25.0] them. So one of the things that I like to think about [00:04:30.0] is figuring out ways that you can involve them that don’t make them feel like they’re restricted. [00:04:35.0]

Lillian Karabaic: [00:04:34.71] So, hopefully if you are in a relationship with them, you [00:04:40.0] can kind of see what’s going on. Maybe they shut down when you talk about money at all because they just don’t want [00:04:45.0] to deal with it. Or maybe they feel like they’re not good at money.

Lillian Karabaic: [00:04:49.39] So if they say [00:04:50.0] like, oh, the finances are your thing, do whatever you want, I recommend just [00:04:55.0] asking them to show up to a budget check in. And then once you get there, ask them [00:05:00.0] about things that are not to do with numbers.

Lillian Karabaic: [00:05:02.86] So if they feel like finances are not their thing, to [00:05:05.0] have the conversations about money that are about goals and dreams and not about numbers [00:05:10.0] and then just shut up and listen while they answer,.

Will Romey: [00:05:12.15] I like that because that kind of makes it less budgeting as an abstract [00:05:15.0] concept. And more bring it back to how money powers your life.

Lillian Karabaic: [00:05:20.03] And [00:05:20.0] I’d probably like you have some shared goals that this person like. They could be really big financial goals [00:05:25.0] that you want to buy a house.

Lillian Karabaic: [00:05:26.77] They could be like wanting to fund school, like private school for your kids, [00:05:30.0] or like taking off to travel the world. But it also to just be something [00:05:35.0] really simple, which is like “I want to stop being incredibly stressed out at the end of every month, because [00:05:40.0] we’re out of money until the next payday.” Right?

Lillian Karabaic: [00:05:41.71] Like it could be, which is like both simple [00:05:45.0] and the most important. Right?

Lillian Karabaic: [00:05:47.05] So having a conversation about like [00:05:50.0] what would it look like? Oh, what would what would it look like if at the end [00:05:55.0] of each month we were able to go out for a nice meal, because we’ve saved enough money to do that?

Lillian Karabaic: [00:05:59.86] What [00:06:00.0] would it look like if, you know, we weren’t in the situation where we had to finance [00:06:05.0] every time we needed a car repair and kind of focus on like that and ideally [00:06:10.0] focus on the positive goals and dreams, if they really have a lot of trouble with this.

Lillian Karabaic: [00:06:14.86] So [00:06:15.0] like, oh, three years from now, what do we want to be able to do? Well, I’d love to be able to quit my job and spend [00:06:20.0] six months, you know -.

Will Romey: [00:06:21.01] On a cruise ship.

Lillian Karabaic: [00:06:22.6] On a cruise ship? I like how that’s your [00:06:25.0] example. It’s always it always comes down to boats with you.

Will Romey: [00:06:27.73] Yeah, I was gonna see a cargo cruise, which I think [00:06:30.0] is way more interesting,.

Lillian Karabaic: [00:06:31.15] Which is that’s a will goal –

Will Romey: [00:06:32.52] We’ve probably talked about that – you can [00:06:35.0] see that in past episodes.

Lillian Karabaic: [00:06:38.89] So like, obviously, I [00:06:40.0] feel like that’s like an easy way to ease into it.

Lillian Karabaic: [00:06:42.67] If you’re in the situation where your partner is, [00:06:45.0] you have some shared finances or there’s just a lot of pressure and they’re overspending and [00:06:50.0] completely blowing your budget. It’s really helpful to remind them of shared goals. So [00:06:55.0] having that conversation about what the shared goals are, OK. “Well, we really one to have a down payment in [00:07:00.0] two years on a house” – but remind them of that goal. [00:07:05.0] Something that hopefully you both share, and then ask for possible solutions to the overspending [00:07:10.0] and let them come up with some of the ideas.

Lillian Karabaic: [00:07:12.79] So like, OK, we agree that this is our goal, [00:07:15.0] but we keep going a hundred dollars a month over in the budget category. And [00:07:20.0] that means that we’re gonna be, you know, another year out in how much we have saved for a house rent. [00:07:25.0]

Will Romey: [00:07:25.21] So maybe maybe go through the implications.

Lillian Karabaic: [00:07:27.2] Yeah. Like actually figuring out what it is. And have them [00:07:30.0] come up with some suggestions. So I’ll give you some suggestions.

Lillian Karabaic: [00:07:32.71] But I like it. I like to like give [00:07:35.0] them ideas because then they feel invested in it. So an idea would be a cash-only [00:07:40.0] budget for fun money; giving you a call before they buy something if they have like impulse control problems [00:07:45.0] like, “hey, maybe text me before you guys drop one hundred and fifty dollars at [00:07:50.0] the bookstore.”.

Will Romey: [00:07:50.08] Cirque du Soleil tickets.

Lillian Karabaic: [00:07:52.12] Yeah, exactly. Implementing waiting periods. [00:07:55.0] We’ve talked before on that. But just remember not to lead with shame or [00:08:00.0] a judgment, because if they’re if they don’t feel great about like overspending, [00:08:05.0] then leading with “you’re overspending and you’re interfering with our [00:08:10.0] budget and like you should be ashamed of yourself”.

Lillian Karabaic: [00:08:11.68] Like, that’s not going to work, nor [00:08:15.0] is really guilt. Like a little bit of guilt can be helpful for some people. [00:08:20.0] Some people respond to that. But I think it’s more helpful to think about like the fun things. [00:08:25.0]

Lillian Karabaic: [00:08:25.33] A little bit of guilt might help, but you hopefully know your significant other well enough to know [00:08:30.0] if a little bit of guilt is helpful. I’m one of those people that responds pretty well to like [00:08:35.0] feeling like I might disappoint someone else. And so a little bit of that is good, but it never, ever [00:08:40.0] helps if someone shames me for it. Right?

Will Romey: [00:08:43.12] Focusing on the positive aspect of [00:08:45.0] budgeting, like you were saying earlier.

Lillian Karabaic: [00:08:47.71] Yeah.

Lillian Karabaic: [00:08:48.94] And then this is kinda related [00:08:50.0] in the next one. Like if you start getting your money together and you’ve got some shared finances and they [00:08:55.0] start to feel like they’re losing control or like, you know, “oh, I don’t want to be boxed in [00:09:00.0] by by having a budget.”.

Lillian Karabaic: [00:09:01.09] Like obviously one you figured out that they feel really restricted by the budget, which [00:09:05.0] gives you good information – because you can like look at other ways to do that.

Lillian Karabaic: [00:09:09.58] But I [00:09:10.0] think that there is a really good category in this case, which is the no-judgment [00:09:15.0] fun money category. And this is each of you getting a budget category that you can use in [00:09:20.0] any way you like with no comments from the other one.

Lillian Karabaic: [00:09:23.47] This even works even better if it’s in [00:09:25.0] cash.

Will Romey: [00:09:25.88] Yea, that’s true – no one’s even seeing the account.

Lillian Karabaic: [00:09:26.13] You just like take the money out in cash. This [00:09:30.0] is one of those categories where if your budget is really tight, it can be really [00:09:35.0] helpful to lead by example in this category. So if you’ve got a no-judgment [00:09:40.0] fun money category, but you’re like, oh, we’re not going to save any money if we both have this category, [00:09:45.0] well- save your fun money category. This is one of those things where you can do some lead by example. [00:09:50.0]

Will Romey: [00:09:50.22] You can do whatever with it.

Lillian Karabaic: [00:09:50.49] Yeah, you can do whatever. And this is one of those things where, you really [00:09:55.0] want to give them some area where they feel like they’re still executing control. Because [00:10:00.0] often, I’ve noticed that the same people that don’t want to do the budget because they feel like they’re losing control, are [00:10:05.0] the same ones that say it’s the finances, you worry about it, not me. Like [00:10:10.0] they you know, we’re complex emotional creatures, right? So we’re like simultaneously. [00:10:15.0] I don’t want to worry about it. But also, I don’t want to lose control. So finding [00:10:20.0] a way where they can feel a little bit invested, and like they have a little bit of control without [00:10:25.0] necessarily getting mired down in the details can be really helpful.

Lillian Karabaic: [00:10:29.05] So what are those partners [00:10:30.0] that are like not your current romantic partner or ever [00:10:35.0] have been, but you still have some expenses that you share. So like people [00:10:40.0] you cohabitate with or someone you co-parent with but don’t live with anymore, you’re [00:10:45.0] still gonna have to talk about money at some point, right?

Will Romey: [00:10:46.99] Anytime you have shared finances, it seems useful.

Lillian Karabaic: [00:10:49.09] Yes. Right. [00:10:50.0] So there you go. On the kind of lower end – there [00:10:55.0] is, you might share housing and not bank accounts, but you maybe share groceries, [00:11:00.0] some grocery expenses for like bulk oils or something like that, or your Internet bill. [00:11:05.0]

Lillian Karabaic: [00:11:06.16] In this case, worry about the things that you do share and only talk about [00:11:10.0] those categories. So, you know, talk about your Internet speeds and whether or not you’re [00:11:15.0] going to go to the farther away grocery store that has the cheaper oil. Don’t talk to them about their [00:11:20.0] student loans. Right?

Lillian Karabaic: [00:11:21.24] So like focus on the things you share.

Will Romey: [00:11:24.15] Right, yea – the things [00:11:25.0] that impact you, really.

Lillian Karabaic: [00:11:25.54] That impact you. And I think it’s really important that like, if [00:11:30.0] you’re in a situation where you have very different finances than the person that you’re living with, to just [00:11:35.0] focus on the things that you do share, because I think often I see a lot of resentment [00:11:40.0] build. if like one roommate makes more money than the other.

Lillian Karabaic: [00:11:43.87] I’ve also seen [00:11:45.0] situations where one roommate doesn’t make more money than the other, but has their finances together. [00:11:50.0] And the other person is kind of in a disaster space. And that’s where I think the leading [00:11:55.0] by example can be really helpful because you’re like, oh,”I actually don’t make that much money, but [00:12:00.0] I, you know, have a plan for it. And I’m not always constantly stressed out about it.”

Lillian Karabaic: [00:12:04.6] And that’s [00:12:05.0] the leading by example, but not judging and not shaming. So if you co-parent with someone you don’t live with, [00:12:10.0] but you know, you still have some sort of relationship with where you’re gonna need to talk [00:12:15.0] about schooling or child care.

Lillian Karabaic: [00:12:17.56] I think it’s very helpful to ground that conversation [00:12:20.0] in values. So talk about the kind of schooling or child care you both want for your [00:12:25.0] kids, but leave judgments out of any other budget categories. So don’t freak out when [00:12:30.0] you see that they spent a bunch of money on cigarettes or, you know, really nice oil [00:12:35.0] paintings.

Will Romey: [00:12:35.74] Comic books.

Lillian Karabaic: [00:12:35.83] Or whatever their vices, comic books – last weekend – just come [00:12:40.0] back to the things that you share in your finances [00:12:45.0] together.

Lillian Karabaic: [00:12:45.44] So, OK, “I really want to make sure we can pay the school fees on time this year. I [00:12:50.0] really want to make sure we can pay for school lunches, or it would be nice to be able to afford camp [00:12:55.0] – that’s 12 months out. How are we going to split that?” How are we going to do that?” and leave judgments [00:13:00.0] out of the other budget categories. I know that’s easier said than done, but you know, that’s [00:13:05.0] one of the goals,.

Will Romey: [00:13:06.88] But we said it.

Lillian Karabaic: [00:13:07.24] Right. Do you have any do you have any strategies you use [00:13:10.0] with roommates, Will?

Will Romey: [00:13:10.93] I mean, I like what you were saying about leading by example. I feel like that [00:13:15.0] can be frustrating when you’re kind of trying to drop hints about other ways people could do things, [00:13:20.0] but not necessarily.

Lillian Karabaic: [00:13:21.28] The classic passive aggressive roommate.

Will Romey: [00:13:23.11] Not, not not even [00:13:25.0] I guess I have friends who do have frustrating spending habits, and I try to be transparent about what I do differently [00:13:30.0] without casting aspersions. I [00:13:35.0] mean, it’s sort for me. So I don’t really care as long as you’re paying rent and bills.

Lillian Karabaic: [00:13:39.35] Right. I [00:13:40.0] think the thing that I have found interesting is that, [00:13:45.0] you know, I feel like a lot of my like anarcho-punk roommates would be [00:13:50.0] kind of, like, annoyed that I seemed to [00:13:55.0] like have it financially together or like, you know, would try to like, oh, you should come out [00:14:00.0] to the bar.

Lillian Karabaic: [00:14:00.25] And I be like eh, You know, it’s not really in the budget this month, blah blah blah blah. But then [00:14:05.0] slowly over time, I think almost at this point, a hundred percent of those roommates [00:14:10.0] have come to me and been like, hey, “I need to figure out what health insurance to get. I don’t understand any of this. Can you [00:14:15.0] help me?” or like. “How? What is a credit score?”.

Lillian Karabaic: [00:14:17.44] You know, like slowly they kind of [00:14:20.0] were like, oh, I need help in this one area. And you seem to be.

Will Romey: [00:14:23.56] You seem to know – you have your money together. [00:14:25.0]

Lillian Karabaic: [00:14:25.44] And I also know that you’re not going to like it, because I think what’s very helpful [00:14:30.0] is that I never would be like, man, maybe you shouldn’t spend three hundred dollars at the bar when you just got [00:14:35.0] paid on Friday and rent’s due next week because they knew that I wasn’t going, I wasn’t going [00:14:40.0] to judge them, even if internally I was like, oh,.

Will Romey: [00:14:43.51] Yeah, I’m judge internally.

Lillian Karabaic: [00:14:45.0] Yeah, [00:14:45.0] yeah. It’s hard when you have a roommate that you do see, you do that. And then at the same time, [00:14:50.0] you’re like, oh, now you can’t pay rent or now you’re late with rent.

Lillian Karabaic: [00:14:55.42] And [00:14:55.0] that’s one of those situations where, you know, that’s kind of a roommate. Discussion [00:15:00.0] situation, more than a finance situation. But this [00:15:05.0] is one of those things where, like I think it’s helpful to only focus [00:15:10.0] on the thing that you need and let them make their own decisions about it, right?

Lillian Karabaic: [00:15:13.85] So like, [00:15:15.0] hey, I need to get rent by the fifth. And like, I don’t care what else you do [00:15:20.0] with your money.

Will Romey: [00:15:20.7] But that’s one important.

Lillian Karabaic: [00:15:20.7] Like you balance and for rent, you keep paying on the eighth or you keep paying on the 10th. [00:15:25.0] And like, focus on like I need this from you because, you [00:15:30.0] know, I’m the one that pays the whole rent check or whatever.

Lillian Karabaic: [00:15:33.51] And when it gets there [00:15:35.0] late, it, you know, really screws things up for me and focusing on kind of the impact [00:15:40.0] that they’re having on you – rather than like. “And I know that you could have afforded [00:15:45.0] it because I saw you, you know, pay the tab for the entire bar last week”

Will Romey: [00:15:49.89] You [00:15:50.0] know that. That was a wild moment.

Lillian Karabaic: [00:15:53.17] Yeah.

Will Romey: [00:15:54.81] Everyone [00:15:55.0] was cheering.

Lillian Karabaic: [00:15:55.17] I mean, that sounds nice.

Will Romey: [00:15:56.94] Probably felt worth it in the moment.

Lillian Karabaic: [00:15:58.02] Yeah, that does sound fun [00:16:00.0] to do at some point on time.

Will Romey: [00:16:01.52] Pay the whole bar’s tab.

Lillian Karabaic: [00:16:03.57] Very small bar.

Will Romey: [00:16:04.17] Yeah.

Lillian Karabaic: [00:16:06.09] One [00:16:05.0] of those bars in Japan that only has like four seats.

Will Romey: [00:16:10.29] Well [00:16:10.0] on that note, tell us. Write in! Write in and tell us about the time you paid for tabs of the whole bar. [00:16:15.0]

Lillian Karabaic: [00:16:15.51] Yeah. I want to hear about the time that you paid for the tab in the whole bar. Actually, I would just love to [00:16:20.0] hear like if you’ve gotten a partner on board, especially if you’ve gotten a partner onboard with [00:16:25.0] like a really big financial thing.

Lillian Karabaic: [00:16:28.98] I think one of the things [00:16:30.0] that I did is that I just didn’t say anything and just slowly started cooking more dinners [00:16:35.0] instead of trying to go out to eat all the time and got got to the point where, [00:16:40.0] you know, my partner realized maybe it was probably better than having just champagne and orange juice as [00:16:45.0] the only things in their fridge.

Lillian Karabaic: [00:16:47.73] So, we love [00:16:50.0] hearing from you.

Will Romey: [00:16:50.49] It’s true!

Lillian Karabaic: [00:16:51.02] So e-mail us your financial worries or successes [00:16:55.0] or anything else at questions@ohmydollar.com or tweet us @anomaly or [00:17:00.0] @ohmydollar

Will Romey: [00:17:01.3] Yep. Our producer is me, Will Romey, and our intro music is by Aaron Parecki. And [00:17:05.0] your host and personal finance educator is Lillian Karabaic. Thanks for listening. And until [00:17:10.0] next time, remember to manage your money so that it doesn’t manage you.