Paying quarterly estimated taxes can be annoyingly scary – not only are you like “WHY ARE YOU TAKING MY MONEY, GOVERNMENT?”

Where to Go!

– This not-so-handy form called IRS Form 1040-ES which will help you estimate your marginal tax rate

– You can pay your taxes and automatically on the IRS’s website using “direct pay” or you can set up an account on the Electronic Federal Tax Payment System

Deadlines for Quarterly Taxes

- For income received Jan. 1 through March 31, estimated tax is due April 15.

- For income received April 1 through May 31, estimated tax is due June 15.

- For income received June 1 through Aug. 31, estimated tax is due Sept. 15.

- And for income received Sept. 1 through Dec. 31, estimated tax is due Jan. 15.

Ask us a question!

We love hearing from you! Email us your financial worries or receipt victories at questions@ohmydollar.com or tweet us at @anomalily or @ohmydollar

An Easy Way to Help

Our iTunes review drive is going on right now! It takes less than 10 seconds to click a star, it’s totally free, can you help us out? Click here to leave a review: https://itunes.apple.com/us/podcast/oh-my-dollar/id1189980636?mt=2

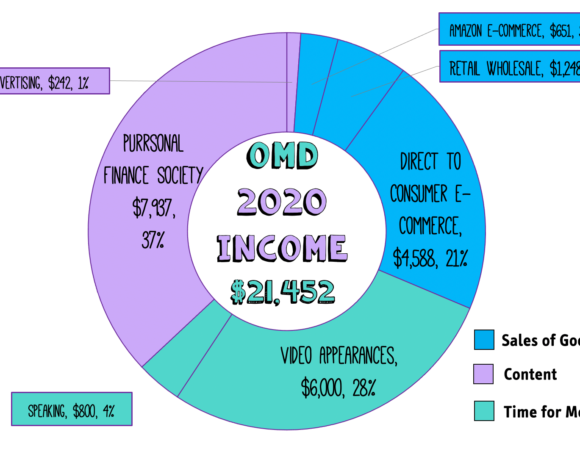

This show is made paw-sible by listeners like you

We absolutely love our Purrsonal Finance Society Members, the folks that generously support Oh My Dollar with $1 or more a month on Patreon – and have made is so we have free, full transcripts for every show on ohmydollar.com This episode was underwritten by patron Tamsen G Association and Warrior Queen. To learn more about being part of the Purrsonal Finance Society and get cool perks like exclusive livestreams and cat stickers, you can visit ohmydollar.com/support

Thank you for this. Every time I contemplate really starting a side hustle, I feel very intimidated by the accounting (especially quarterly taxes) and then allow that to be one of many excuses for not hustling. Every time I get more info on quarterly taxes that’s clear and helpful, the less that can be an excuse…

The good news is that the first year of your side hustle, you don’t need to worry about them at all. It’s only for your second year of business and beyond. So go side hustle if it’s what your heart desires!

See, things I did not even know there. So much to learn!

So much to learn!

My tax software says I might need to pay in installments next year

My government says:

You hustled! Congrats, now you can pay all your cpp because you are self employed

You hustled 30 grand! Level up, you can pay HST and we will make you regret every minute!

You made 40 grand do do do dooooo! New chalkenge: more accounting and quarterly taxes!

I feel so unimpressed